What makes you great is how you grow.

There’s a staggeringly good chance you’re aware of the 4Ps.

- Product. Ideally, you have a fantastic, meaningfully differentiated product.

- Pricing. Maximize both sales and margins. Price is, of course, wildly psychological (bottle of wine, anyone?), but that’s a Dispatch for another day.

- Place. Your brand must be easy to find both in stores and online.

- Promotion. A brilliant long game to drive fame, feeling and fluency. And a smart, strategic short game to drive sales. The “and” is big here.

Nike temporarily forgot them.

In 2020, then-CEO John Donahue decided that Nike should become a D2C brand. Former Nike senior brand director Massimo Giunco wrote a tasty LinkedIn article about it. Tea is spilled. It’s worth a read.

Here’s the TL;DR version:

Product. Nike collapsed their various sports divisions into men's, women’s and kids’ lines. Instead of pushing innovation, they focused on older, established products.

Pricing. Because Nike increasingly pulled their business online — and because of self-inflicted supply chain issues — they fell into a spiral of discounts and promotions.

Place. They ended partnerships with retailers to focus on becoming a D2C brand. Nike gave away shelf space. To their competitors. On purpose.

Promotion. The masters of brand advertising cut brand advertising and pumped billions of dollars into short-term, hyper-targeted activation tactics to drive customer loyalty and repeat sales.

They also let go of a lot of people who knew a whole lot about innovation, clothing design, sports, manufacturing, distribution, sales, marketing, procurement, supply chain management, etc.

How’d it go?

On June 27th, 2024, Nike announced their FY Q4 earnings. The numbers were not super great.

According to Reuters, “Fourth-quarter net revenue slipped 1.7% to $12.61 billion falling short of estimates of $12.84 billion. For the first quarter, Nike forecast a roughly 10% fall in revenue, compared with expectations of a 3.16% fall.”

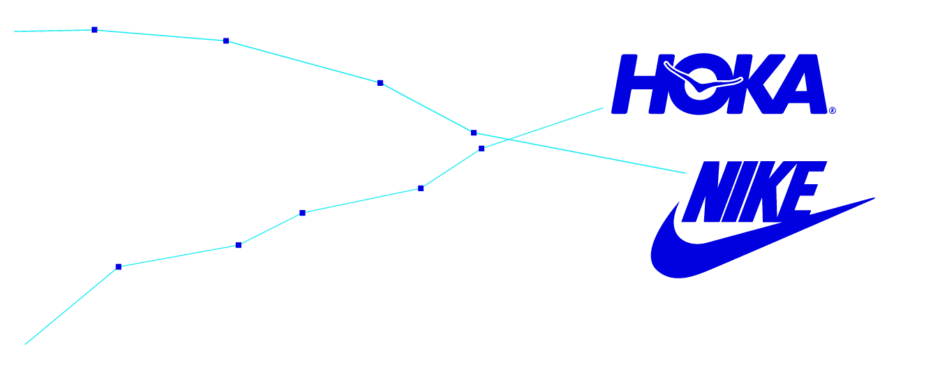

Market share had also been declining slowly but steadily since 2021.

After the announcement, Nike lost $28 billion of market cap. Share price dropped 20%, and shares were down 32% from the beginning of the year.

It was all very much an own goal.

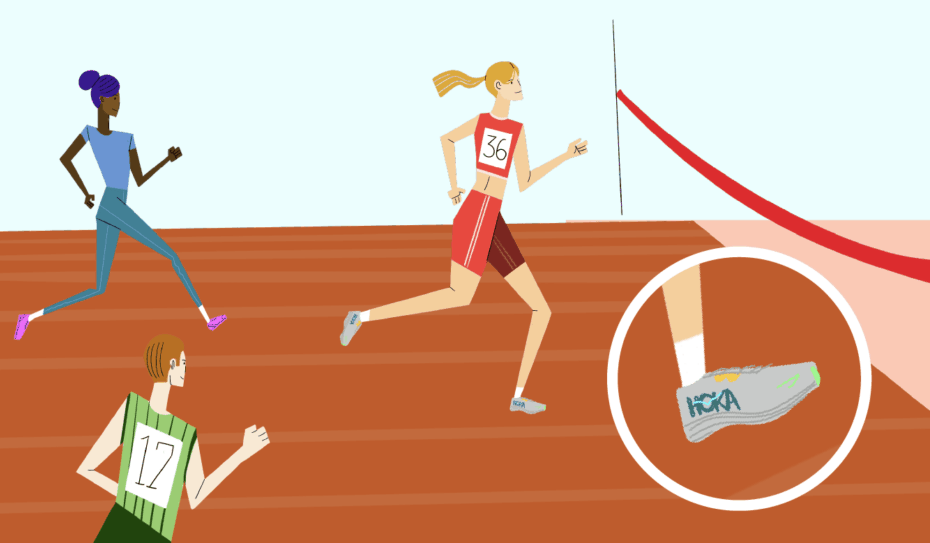

One of the categories where Nike got hit hardest was running. Challenger brands like Hoka, On and Asics started to nibble away at Nike’s market share.

Time for a quick Hoka origin story …

Back in the early aughts, two athletes and former Salomon employees had a very specific, very niche problem. Nicolas Mermoud and Jean-Luc Diard wanted to run faster down steep, rocky, mountain trails.

Running down rocky terrain hurts. And the faster you go the more it hurts. But all the running shoe brands back then were focused on lightweight, minimalist designs with very little cushioning. No one had what they wanted.

So Mermoud and Diard designed a new style of running shoe with a chonky midsole and a unique rocker shape. The shoes looked strange, but they worked.

Hoka was born. And then they started growing.

Ultramarathoners started wearing them and winning in them, which helped get the word out.

Ultramarathoning is a very niche sport, but Hoka is not a niche brand

Because by solving their “running fast downhill” problem, Mermoud and Diard also solved a problem that a lot of other people were having.

Speed matters, obviously, but a lot of people just need shoes that allow them to get out there and run. And even elite athletes need shoes that don’t kill their feet, knees, shins and hips.

Hoka developed a distinctive and meaningfully differentiated product in a highly competitive and mature category that Nike helped build.

Hoka sponsored elite trail, triathlon and road & track athletes. They partnered with podiatrists. They got their shoes into specialty running stores. They collaborated with brands like Outdoor Voices. They hosted events and grew a running club.

Hoka took off.

And a whole lot of people — runners, casual runners, older runners, walkers and hikers, people like nurses who spend hours on their feet, celebrities like Britney Spears — discovered Hokas and found them to be, well, comfortable. And different. And interesting. And kind of cool. And really, really good for running, trail running, hiking and everyday wear.

In 2022, they hit $1 billion in sales and launched their first global advertising campaign called “Fly Human Fly”. In FY 2024, they hit $1.8 billion in sales.

They even put a pair of Hokas on the Statue of Liberty. Well, sort of.

What about pricing? Hokas are, to borrow an old, brilliant Stella Artois tagline, “reassuringly expensive.” Because among other things, pricing is a signal of brand quality, buyer status and buyer aspirations.

And place? They aren’t quite everywhere yet, but you can find them in specialty running stores and in a few major retailers across the country. Hoka now has flagship stores in Paris and New York. And they’re online, of course. Omnichannel FTW!

Even though they have been very smart about the 4Ps, Hoka’s massive growth might not have happened if Nike had been playing their usually brilliant game of offense and defense.

Instead, Nike opened the door. Brands like Hoka ran right through.

Nike is still the category leader by miles. In a disappointing year, they did $51.4 billion in revenue (that’s shoes, clothing and gear — they sell a lot of stuff). There’s a big mess to clean up, and it will take time, but Nike’s new CEO, Elliott Hill, seems right for the job. Still …

For Nike to give up on innovation, lose the plot on pricing, concede shelf space, throw long-term brand advertising out the window, and shed so much industry knowledge and experience is mind-boggling.

So what does this mean for you?

The 4Ps matter no matter how big you are.

If you’ve got something truly innovative and meaningfully different, keep going. Category leaders will eventually catch up, but a strong brand will help you play defense when the time comes.

Loyalty is mostly a function of brand size not brand love. Lots of light buyers are continuously up for grabs. Grab them.

And never, never ever interrupt a category leader while they are making a mistake.

While Nike was tripping over its own laces, Hoka was making great shoes and great strides. They carefully but relentlessly grew their audience, their brand and their market share.

We’ll see you next time.

Sources!

Nike: An Epic Saga of Value Destruction - Massimo Giunco, LinkedIn

Nike Faces Unprecedented Stock Plunge Amid Strategic Missteps - The Global Treasurer

Amid a Reset, Nike Is Leaving Market Share on the Table: Here’s How Brands Like Adidas, Hoka and On Can Move In - footwearnews.com

DECKERS BRANDS REPORTS FOURTH QUARTER AND FULL FISCAL YEAR 2024 FINANCIAL RESULTS - ir.deckers.com

Back In The Running - Footwear Plus Magazine

Hoka’s new high-flying ads look to build on $1B sales momentum | Marketing Dive

Nike's new CEO may look to mend retailer ties in sales revival push | Reuters